|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

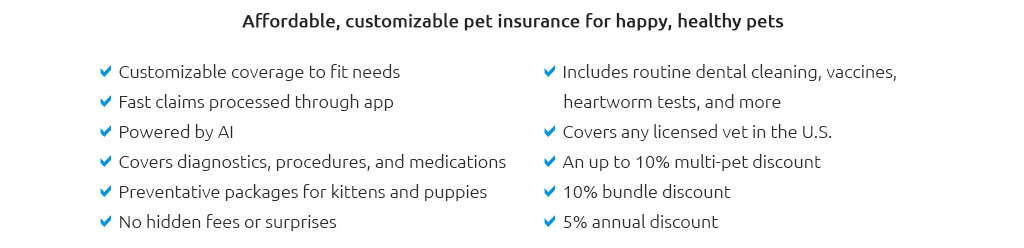

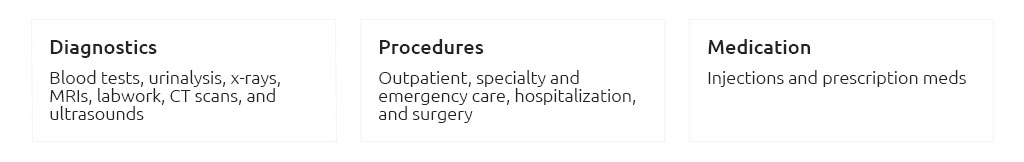

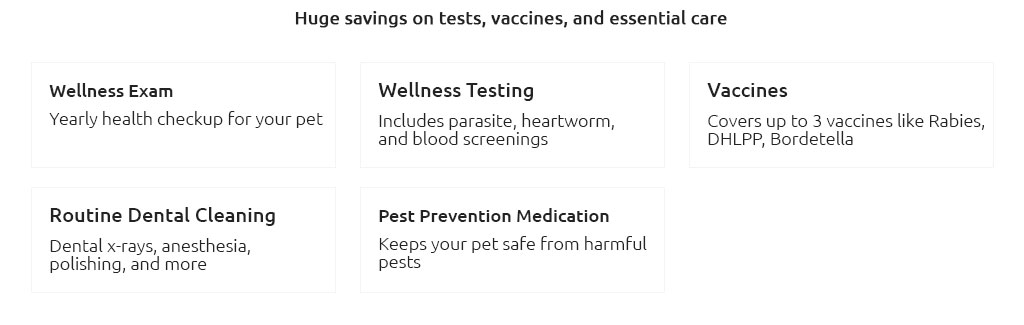

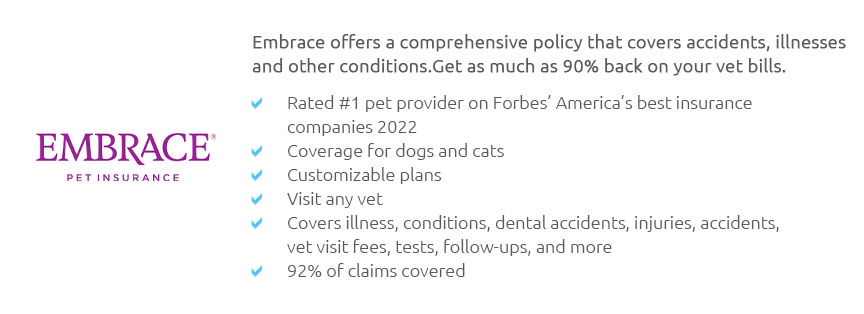

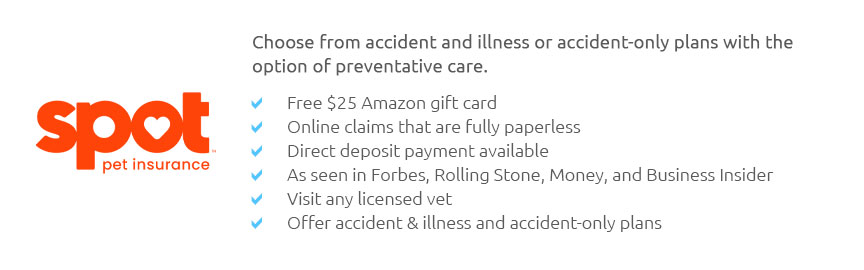

Understanding Pet Insurance in CaliforniaPet insurance, a burgeoning industry in California, is designed to provide pet owners with a financial safety net in the event of unforeseen veterinary expenses. As more Californians embrace pets as integral family members, the demand for comprehensive insurance coverage has grown substantially. But what exactly does pet insurance entail, and is it truly a necessity for pet owners in the Golden State? Firstly, pet insurance operates similarly to human health insurance, offering various plans that cover a range of medical treatments. Policies typically include accident and illness coverage, while some offer wellness plans for routine care. However, navigating the plethora of options can be daunting. It is crucial for pet owners to evaluate their specific needs and consider factors such as the pet's breed, age, and pre-existing conditions. In California, the diverse range of pet insurance providers includes well-known names like Nationwide, Healthy Paws, and Trupanion. Each offers distinct features and benefits. For example, Nationwide provides a comprehensive plan that covers not just cats and dogs, but also exotic pets, which is particularly appealing in a state with a penchant for unique animal companions. Many Californians question whether pet insurance is worth the investment. While monthly premiums can range significantly, from as low as $20 to over $100, the peace of mind it offers in potential situations of high-cost veterinary bills is invaluable. With veterinary care costs continually rising, having insurance can mean the difference between life-saving treatment and financial hardship. Moreover, understanding the nuances of each policy is vital. Policyholders should be aware of terms such as deductibles, reimbursement rates, and coverage limits. Most plans work on a reimbursement basis, meaning pet owners pay the vet directly and then file a claim with their insurer. This process underscores the importance of choosing a plan with a reimbursement rate that aligns with one's financial situation.

Ultimately, the decision to purchase pet insurance in California hinges on individual circumstances. For some, the assurance that they can provide their beloved pets with top-tier medical care without the specter of insurmountable bills is worth every penny. For others, especially those with healthy, young animals and a reliable savings plan, the cost may outweigh the benefits. However, as with any insurance, it's about preparing for the unexpected, and in a state renowned for its love of pets, ensuring their well-being is often a top priority. In conclusion, pet insurance in California represents a thoughtful consideration for pet owners seeking to safeguard their furry family members against life's uncertainties. By evaluating different policies, understanding coverage details, and aligning choices with personal and pet needs, Californians can make informed decisions that best protect their pets' health and their own financial stability. https://www.lemonade.com/pet/explained/california-pet-insurance-guide/

eligible accidents and illnesses. Here are some common types of care that Lemonade pet ... https://www.cbsnews.com/sanfrancisco/news/california-pet-insurance-rules-gavin-newsom-sb1217/

A bill signed by California Gov. Gavin Newsom will force pet insurers to provide more transparency about their coverage. https://www.petinsurance.com/whats-covered/california/

Get comprehensive pet insurance coverage in California. Protect your furry friend's health and save on vet bills with Nationwide. Explore our plans today!

|